Step into the intricate world of accounting with the general ledger of the Karlin Company. This cornerstone of financial reporting serves as a meticulous record of every transaction, providing invaluable insights into the company’s financial health and performance.

As we delve into the depths of the general ledger, we will unravel its structure, organization, and the principles that govern its meticulous maintenance. Its role in recording and summarizing financial transactions will become evident, laying the foundation for a comprehensive understanding of the company’s financial journey.

The General Ledger Overview: The General Ledger Of The Karlin Company

The general ledger is the central repository for all financial transactions of a company. It is a systematic record of all financial activity, providing a comprehensive overview of a company’s financial position and performance.

The general ledger is structured into accounts, which are categorized according to the type of transaction they represent. For example, there are accounts for assets, liabilities, equity, revenues, and expenses.

The general ledger plays a vital role in recording and summarizing financial transactions. When a transaction occurs, it is recorded in a journal. The journal entry is then posted to the appropriate account in the general ledger.

The General Ledger Accounts

The general ledger contains a variety of accounts, each representing a specific aspect of a company’s financial position or performance.

- Asset accountstrack the value of a company’s assets, such as cash, inventory, and equipment.

- Liability accountstrack the value of a company’s liabilities, such as accounts payable and notes payable.

- Equity accountstrack the value of a company’s equity, such as common stock and retained earnings.

- Revenue accountstrack the value of a company’s revenues, such as sales and interest income.

- Expense accountstrack the value of a company’s expenses, such as salaries and rent.

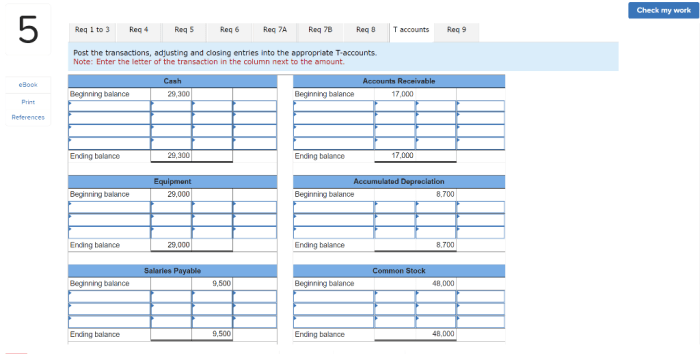

The General Ledger Posting Process

The general ledger posting process involves transferring transactions from source documents to the general ledger.

The first step in the posting process is to record the transaction in a journal. The journal entry includes the date of the transaction, the account to be debited, the account to be credited, and the amount of the transaction.

Once the journal entry has been created, it is posted to the appropriate account in the general ledger. The posting process involves updating the balance of the account by either increasing or decreasing it by the amount of the transaction.

The General Ledger as a Tool for Financial Analysis

The general ledger can be used as a tool for financial analysis. By analyzing the data in the general ledger, analysts can identify trends, anomalies, and areas for improvement.

For example, an analyst can use the general ledger to identify trends in revenue and expenses. This information can be used to forecast future financial performance and to make informed decisions about the company’s operations.

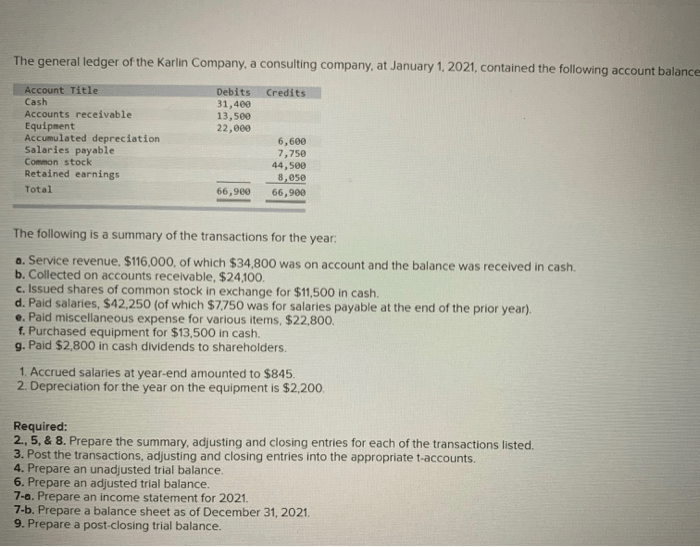

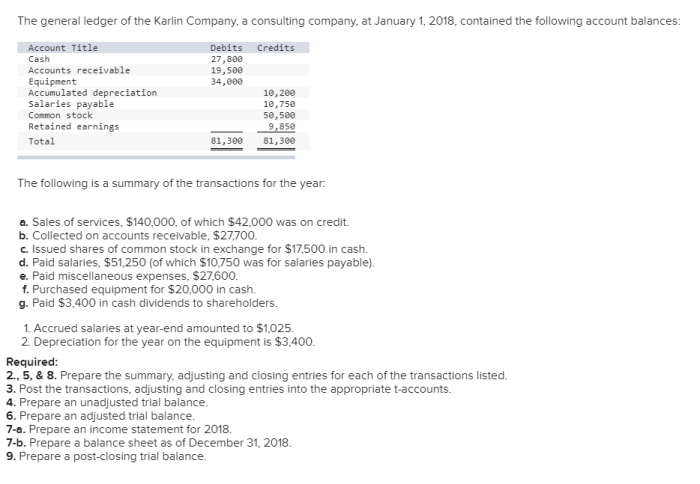

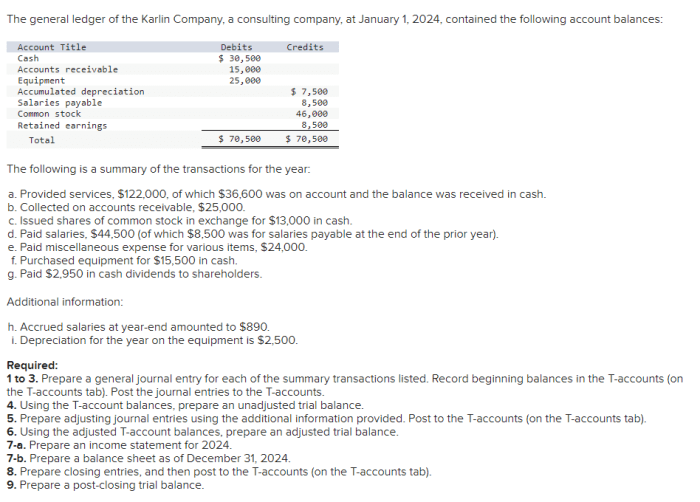

Case Study: The General Ledger of the Karlin Company

The general ledger of the Karlin Company provides a comprehensive overview of the company’s financial position and performance.

The general ledger shows that the Karlin Company has a strong financial position. The company has a healthy amount of cash and marketable securities, and its debt-to-equity ratio is low.

The general ledger also shows that the Karlin Company has been profitable in recent years. The company’s net income has grown steadily, and its profit margin is healthy.

FAQ Section

What is the significance of the general ledger in accounting?

The general ledger serves as the backbone of accounting, providing a systematic and chronological record of all financial transactions. It offers a comprehensive overview of the company’s financial activities, enabling the preparation of financial statements and analysis of financial performance.

How is the general ledger structured and organized?

The general ledger is typically organized into a chart of accounts, which categorizes accounts based on their nature and function. Each account has a unique account number and a descriptive title, ensuring clear identification and traceability of transactions.

What is the role of the general ledger in financial analysis?

The general ledger provides a wealth of data for financial analysis. By examining trends, anomalies, and relationships within the ledger, analysts can identify areas for improvement, assess financial performance, and make informed decisions.