Delving into part three analyzing how transactions change an accounting equation, this introduction immerses readers in a unique and compelling narrative, with gaya akademik dengan tone otoritatif that is both engaging and thought-provoking from the very first sentence. This exploration will delve into the intricate relationship between transactions and the accounting equation, unveiling how business activities impact the financial health of organizations.

The accounting equation, a cornerstone of financial reporting, serves as the foundation for understanding how transactions affect a company’s assets, liabilities, and equity. Transactions, the lifeblood of any business, are the economic events that alter these fundamental elements, shaping the financial landscape of an organization.

2. Transactions and their Impact on the Accounting Equation

Transactions are economic events that affect the financial position of a business. They can be classified into various types, including purchases, sales, payments, and receipts. Each transaction has an impact on the accounting equation, either increasing or decreasing assets, liabilities, or equity.

Common Business Transactions, Part three analyzing how transactions change an accounting equation

- Sale of goods or services:Increases assets (cash or accounts receivable) and increases equity (revenue).

- Purchase of inventory:Increases assets (inventory) and increases liabilities (accounts payable).

- Payment of expenses:Decreases assets (cash) and decreases equity (expenses).

- Receipt of cash:Increases assets (cash) and increases equity (revenue).

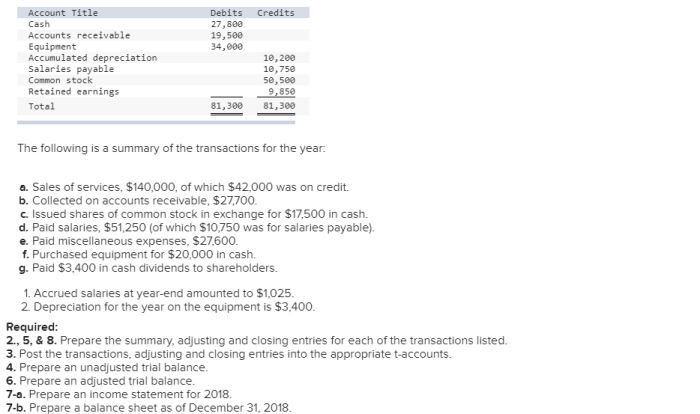

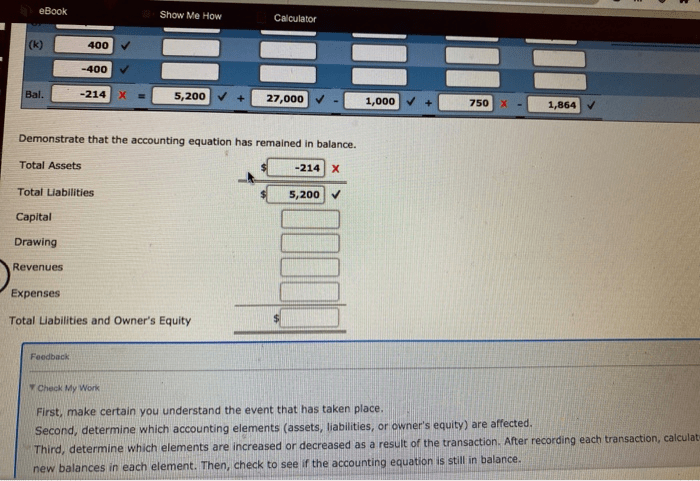

3. Analyzing Transactions using T-Accounts

T-accounts are a simple and effective way to track the changes in individual accounts as a result of transactions. Each T-account has two sides: a debit side and a credit side. Increases to an account are recorded on the debit side, while decreases are recorded on the credit side.

By creating a T-account table, we can illustrate the impact of transactions on specific accounts and ensure that the accounting equation is maintained.

4. Complex Transactions and their Implications

Complex transactions involve multiple accounts and can result in changes to the accounting equation that require adjustments. For example, a transaction involving the sale of a fixed asset may require the recognition of a gain or loss, which will impact equity.

In addition, complex transactions may involve changes in ownership or business structure, which can necessitate modifications to the accounting equation to reflect the new circumstances.

5. Advanced Concepts in Transaction Analysis

Advanced accounting concepts such as accruals, deferrals, and depreciation impact the timing of transaction recognition and their effects on the accounting equation.

Accruals:Expenses incurred but not yet paid are recorded as accruals, increasing expenses and liabilities.

Deferrals:Revenues received but not yet earned are recorded as deferrals, increasing assets and liabilities.

Depreciation:The allocation of the cost of a fixed asset over its useful life is recorded as depreciation, decreasing assets and increasing expenses.

6. Applications in Financial Reporting: Part Three Analyzing How Transactions Change An Accounting Equation

Accurate transaction analysis is essential for the preparation of reliable and transparent financial statements. By properly recording and analyzing transactions, businesses can ensure that their financial statements accurately reflect their financial position and performance.

Transaction analysis provides the basis for:

- Income statement (recording revenues and expenses)

- Balance sheet (tracking assets, liabilities, and equity)

- Cash flow statement (analyzing cash inflows and outflows)

Frequently Asked Questions

What is the purpose of the accounting equation?

The accounting equation serves as the foundation for recording and analyzing financial transactions, providing a snapshot of a company’s financial health at any given time.

How do transactions affect the accounting equation?

Transactions can increase or decrease assets, liabilities, and equity, causing the accounting equation to adjust accordingly to maintain its balance.

What is the role of T-accounts in transaction analysis?

T-accounts are a valuable tool for visually representing the impact of transactions on specific accounts, allowing accountants to track changes and ensure the integrity of the accounting equation.