Economics worksheet monetary policy and the federal reserve explores the fundamental principles of monetary policy and the crucial role played by the Federal Reserve in shaping the economic landscape. This comprehensive guide unravels the intricacies of monetary tools, their impact on economic growth, inflation, and unemployment, and the challenges associated with implementing effective monetary policies in a dynamic global environment.

Delving into the mechanics of monetary policy, we will examine the various instruments employed by the Federal Reserve to influence the money supply, interest rates, and credit availability. By understanding how these tools operate, we gain insights into how monetary policy can stimulate or curb economic activity, control inflation, and promote employment.

Introduction

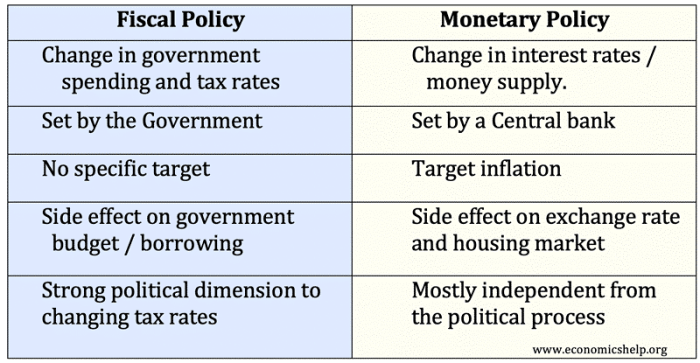

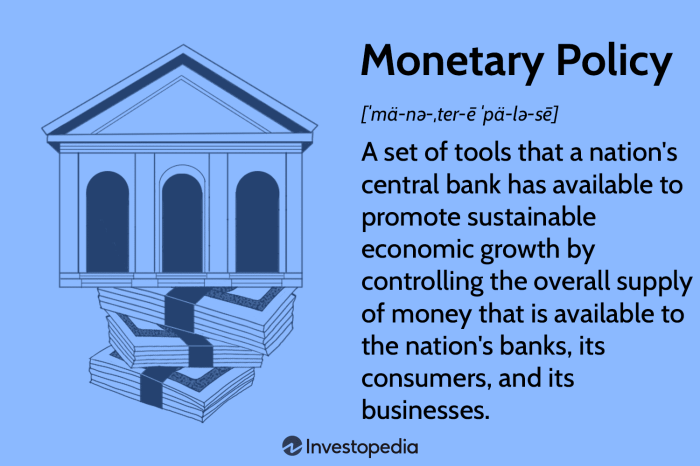

Monetary policy is a set of actions taken by a central bank to control the money supply and interest rates in an economy. It is used to influence economic activity, manage inflation, and promote economic growth.

The Federal Reserve is the central bank of the United States. It is responsible for implementing monetary policy and regulating the financial system.

Tools of Monetary Policy: Economics Worksheet Monetary Policy And The Federal Reserve

The Federal Reserve uses a variety of tools to implement monetary policy. These tools include:

- Open market operations: Buying and selling government securities in the open market to increase or decrease the money supply.

- Discount rate: The interest rate charged to banks for loans from the Federal Reserve.

- Reserve requirements: The amount of money that banks are required to hold in reserve.

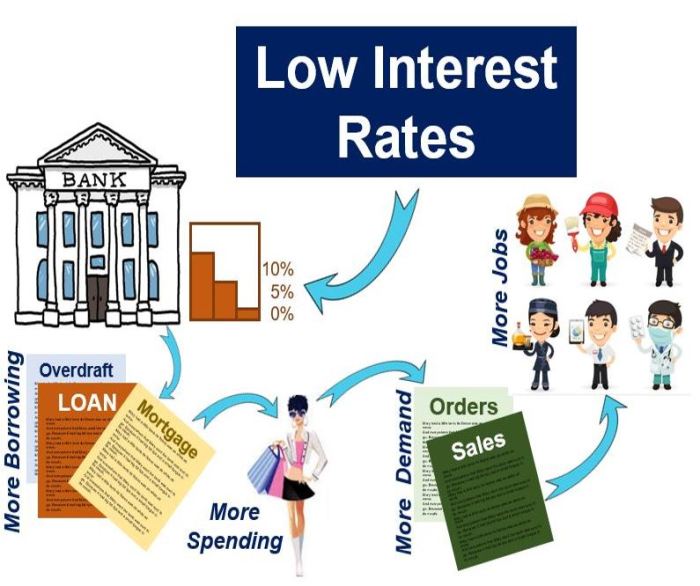

Monetary Policy and Economic Growth

Monetary policy can be used to stimulate or slow down economic growth. By increasing the money supply and lowering interest rates, the Federal Reserve can encourage borrowing and spending, which can lead to economic growth.

However, if the money supply is increased too quickly, it can lead to inflation. Therefore, the Federal Reserve must carefully balance the need to promote economic growth with the need to control inflation.

Monetary Policy and Inflation

Inflation is a general increase in prices and fall in the purchasing value of money. Monetary policy can be used to control inflation by reducing the money supply and raising interest rates.

By making it more expensive to borrow money, the Federal Reserve can reduce demand for goods and services, which can lead to lower prices.

Monetary Policy and Unemployment

Unemployment is a situation in which people are unable to find work. Monetary policy can be used to reduce unemployment by increasing the money supply and lowering interest rates.

By making it cheaper to borrow money, the Federal Reserve can encourage businesses to invest and hire more workers.

Challenges of Monetary Policy

Implementing monetary policy is not without challenges. One challenge is that the effects of monetary policy can take time to materialize.

Another challenge is that economic uncertainty and global events can affect the effectiveness of monetary policy.

Detailed FAQs

What is the primary objective of monetary policy?

The primary objective of monetary policy is to maintain price stability, foster sustainable economic growth, and promote full employment.

How does the Federal Reserve implement monetary policy?

The Federal Reserve implements monetary policy primarily through open market operations, changes in reserve requirements, and adjustments to the discount rate.

What is the relationship between monetary policy and inflation?

Monetary policy can influence inflation by affecting the money supply and interest rates. Expansionary monetary policy can lead to higher inflation, while contractionary monetary policy can help control inflation.