Contractionary monetary policy should initially change gross investment by altering interest rates, credit availability, and business expectations. This policy aims to curb inflation and stabilize the economy, but it can have significant implications for investment decisions.

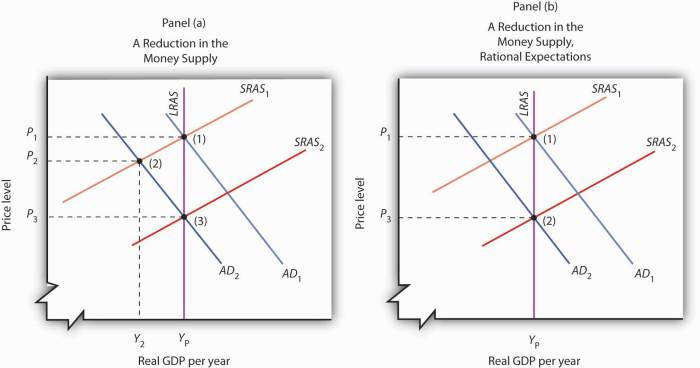

Contractionary monetary policy involves raising interest rates, which makes borrowing more expensive for businesses and individuals. This reduces the incentive to invest, as the cost of capital increases. Additionally, contractionary monetary policy can tighten credit availability, making it more difficult for businesses to obtain loans for investment projects.

Definition of Contractionary Monetary Policy: Contractionary Monetary Policy Should Initially Change Gross Investment By

Contractionary monetary policy is a set of measures taken by a central bank to reduce the money supply and increase interest rates. The primary objective of contractionary monetary policy is to curb inflation and maintain price stability.

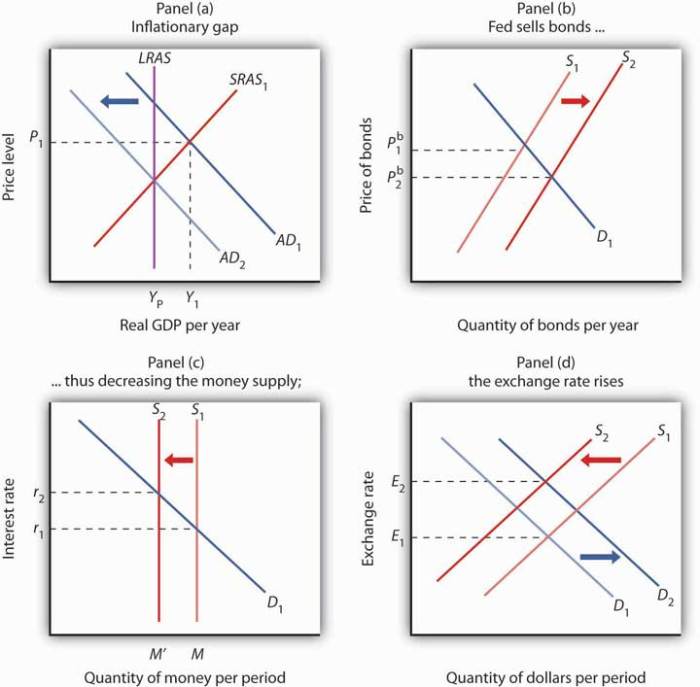

Examples of contractionary monetary policy tools include:

- Increasing the reserve requirement ratio

- Raising the discount rate

- Selling government securities

Impact on Gross Investment

Contractionary monetary policy initially reduces gross investment by increasing interest rates.

Higher interest rates make it more expensive for businesses to borrow money and invest in new projects. This, in turn, reduces the overall level of investment in the economy.

Channels of Transmission, Contractionary monetary policy should initially change gross investment by

Contractionary monetary policy affects gross investment through several channels:

- Credit availability:Higher interest rates make it more difficult for businesses to obtain loans, which reduces their ability to invest.

- Cost of capital:Higher interest rates increase the cost of capital for businesses, making it more expensive to finance new investments.

- Business expectations:Contractionary monetary policy can also affect business expectations. When interest rates are high, businesses may expect future economic growth to be slower, which can discourage them from investing.

Common Queries

What is the primary objective of contractionary monetary policy?

To curb inflation and stabilize the economy.

How does contractionary monetary policy affect investment decisions?

By raising interest rates and tightening credit availability, making borrowing more expensive and reducing the incentive to invest.

What are the potential negative effects of contractionary monetary policy on investment?

Reduced investment can lead to slower economic growth and job losses.